In Bangladesh Government impose some regulation every year regarding VAT & Tax. Tax & VAT calculation from bill is the trickiest part. Due to proper knowledge of Tax & VAT, Contractor, supplier will suffer losses. Most of the cases they avoid Tax & VAT.

Here the question is What is contract? How to calculate Tax & VAT from Contractor Bill? How to calculate Tax & VAT from Supply of Goods? In which cases, TDS will not deduct from imported goods? How to deduct tax if the goods are supplied by the dealer / distributor / supplier under section 94? what will do if payee fails to submit proof of submission of return at the time of making the payment?

I will help you answer all these question in this post. You’ll get a practical insight on how to calculate tax & VAT from Contractor, supplier bill. Just follow & utilize this error free calculation. Let’s start.

What is contract?

“Contract” includes a sub-contract, any subsequent contract, an agreement or an arrangement, whether written or not; [Income Tax Act-2023 Section 140(2)]

How to calculate Tax & VAT from Contractor Bill?

Tax & VAT calculation from contractor bill can be confusing task, if you don’t have proper knowledge of Vat & Tax. Before calculating VAT & Tax from contractor bill you have to find out base amount.

Base amount is the higher of the

(i) contract value or

(ii) Bill or invoice amount or

(iii) payment.

Let’s see some practical examples;

Example-1 Determine the base amount?

- contract value = tk. 6,000,000

- Bill amount = tk. 3,200,000

- Payment = 3,100,000

Here contract value is higher, base amount is tk. 6,000,000.

Example-2 Determine the base amount?

- contract value = tk. 6,000,000

- Bill amount = tk. 6,200,000

- Payment = 5,100,000

Here bill amount is higher, base amount is tk. 6,200,000.

Example-3 Determine the base amount?

- contract value = tk. 6,000,000

- Bill amount = tk. 6,100,000

- Payment = 5,100,000 (After adjustment of old machinery tk. 1,200,000)

Here payment amount is higher because total payment tk. (5,100,000 + 1,200,000) tk. 6,300,000 (base amount)

Once you determine base amount you need to follow 4 Easy Steps to Calculate your Tax & VAT from Bill.

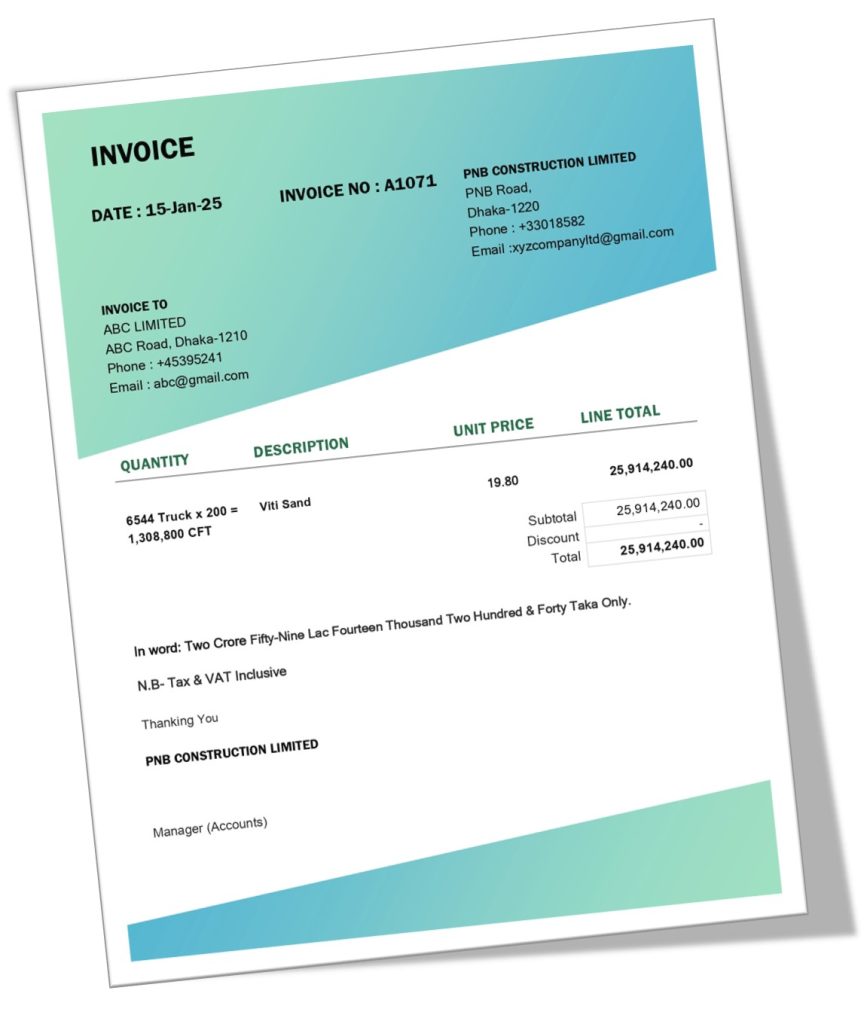

Practical Example-1

PNB Construction Limited entire a contract with ABC Company Limited. Contract Value tk. 30,000,000.

Calculation Process

Now we have to determine base value. We know base value is higher of contract value, bill amount & payment.

- contract value = tk. 30,000,000

- Bill amount = tk. 4,990,990

- Payment = ???

Here contract value is higher. So base value tk. 30,000,000 & TDS rate will be 7% for all bill. [Section 89 Rule-3]

Now we have to follow 4 Easy Steps to Calculate your Tax & VAT from Bill.

Step-1 VAT deduct from bill.

Above mention bill included a term “Including Tax & VAT”. So we have to calculate & deduct VAT as Law (S.R.O No.240-AIN/2021/163-VAT). This bill treated as Construction Company (S004.00) VAT rate @ 7.5%

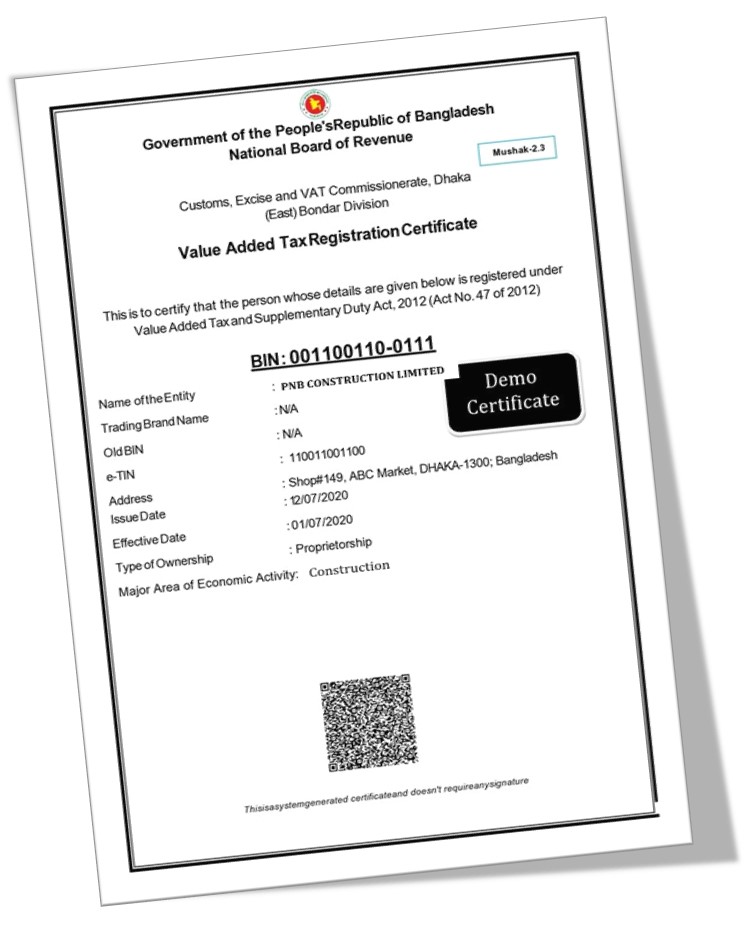

[N.B – If you are confused to treated a bill for Construction Company, you have to collect supplier BIN Certificate to identify nature of this bill.]

Construction Company Bill

Step-1 Calculate VAT Amount.

Bill Amount = tk. 25,914,240

VAT = 25,914,240 x 7.5/107.5 = tk. 1,807,970.

So, you must deduct VAT tk. 1,807,970.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 25,914,240 – 1,807,970

= tk. 24,106,270

Step-3 Calculate Tax Amount from Base Value.

Tax = Base Value x Rate of Tax

= 24,106,200 x 7%

= tk. 1,687,439

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 24,106,200 – 1,687,439

= tk. 22,418,831

Total payment amount from this bill tk. 22,418,831 after deducting TDS & VDS.

How to calculate Tax & VAT from Supplier Bill?

Tax & VAT deduction from supplier bill is the common term in Bangladesh. you are bound by law to deduct Tax & VAT from supplier bill.

VAT Rate for Supplier Bill

| Reference | Description | VAT RATE |

| S037.00 | Procurement Provider | 10% |

| S024.00 | Furniture Manufacturer | 7.5% |

| S024.00 | Furniture Manufacturer Directly Sold to Final Consumer | 15.0% |

| S024.00 | Furniture Trading Center-(Showroom) (If Challan having VAT paid @ 7.5% on manufacturing stage, otherwise 15%) | 7.5% |

| S024.00 | Furniture Trading Center-(Showroom) (If Challan having VAT not paid @ 7.5% on manufacturing stage, otherwise 15%) | 15.0% |

| S008.10 | Printing Press | 15% |

| S008.20 | Binding Firm | 0.00% |

| Section-15 (3) or Third Schedule Paragraph 3 | Standard Rate or VAT rates for Diesel, Kerosene, Octane, Petrol, Furnace Oil and LP Gas | 15% 2% |

| 72.13 to 72.16 | (a) MS products manufactured from imported/locally collected re-rollable scrap | 1400 taka (Per metric ton) |

| 72.13 to 72.16 | (b) All types of billets and ingots manufactured from imported/locally collected meltable scrap. | 1200 taka (Per metric ton) |

| 72.13 to 72.16 | (c) MS products manufactured from billets / ingots | 1200 taka (Per metric ton) |

| 72.13 to 72.16 | (d) Ingots/billets made from mace/meltable scrap and MS products made from ingots/billets | 2200 taka (Per metric ton) |

Tax rate for supplier bill

| Deduction of tax at source from supply of cigarettes, biri, tobacco leaf, gul and other tobacco products | 10% |

| Service provided against contracts executed for manufacturing, processing or conversion, construction work, engineering or any other similar work | 7% |

The rate of tax deduction from the following classes of persons as follows:

| Description | Rate |

| In case of locally procured MS Scrap | 0.5% |

| In case of oil supplied by oil marketing companies engaged in marketing of petroleum oil and lubricant | 0.60% |

| In case of supply of oil by dealers or agents of petroleum oil marketing companies | 1% |

| In case of supply of rice, wheat, potato, onion, Fish, Meat, Onion, Garlic, Peas, Chickpeas, Lentils, Ginger, Turmeric, Dry Chilies, Dal, Maize, Flour, Flour, Salt, Edible Oil, Sugar, Pepper, Cardamom, Cinnamon, Cloves, dates, bay leaves, jute, cotton, yarn | 1% |

| All Kinds of Fruits Supply | 2% |

| In case of an industrial undertaking engaged in the production Cement, Iron or Iron Products, ferro alloy products except MS Billets | 2% |

| In case of supply of oil by any company engaged in oil refinery, on any amount | 2% |

| In case of an industrial undertaking engaged in producing cement, iron or iron products, ferro alloy products except MS Billets, on any amount | 2% |

| In case of company engaged in gas distribution, on any amount | 2% |

| In case of company engaged in gas transmission | 3% |

| In case of supply of 33 KV to 500 KV Extra High Voltage Power Cable manufactured by such a company at local level having its own Vertical Continuous Vulcanization line | 3% |

| In case of supply of books to a person other than the Government, or any authority, corporation or body of the Government, including all of its attached and sub-ordinate offices | 3% |

| In case of Supply of Recycled Lead | 3% |

| In case of supply of raw materials used in industrial production | 3% |

| In case of supply of all goods not mentioned in table serial no. 1 to 12 b. In all other cases mentioned in section 89- | 5% |

You can simply calculate Tax & VAT supplier bill below mention tricks:

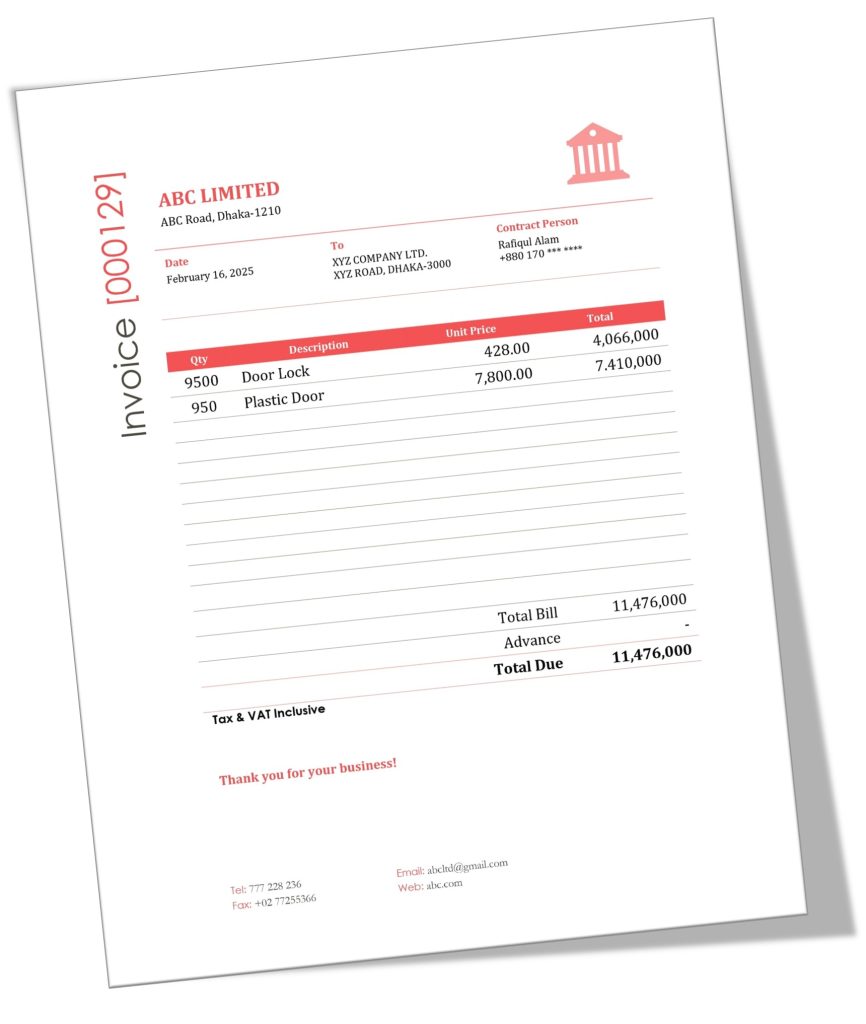

Practical Example-2

XYZ company Ltd. provide various product supply to ABC Ltd. XYZ company Ltd. submit below mention bill. You required to calculate Tax & VAT from this bill.

Step-1 Calculate VAT Amount.

Bill Amount = tk. 11,476,000

VAT = 11,476,000 x 10/110 = tk. 1,043,273

So, you must deduct VAT tk. 1,043,273

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 11,476,000 – 1,043,273

= tk. 10,432,727

Step-3 Calculate Tax Amount from Base Value.

Tax = Base Value x Rate of Tax

= 10,432,727 x 5%

= tk. 521,636

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 10,432,727 – 521,636

= tk. 9,911,091

Total payment amount from this bill tk. 10,141,581 after deducting TDS & VDS.

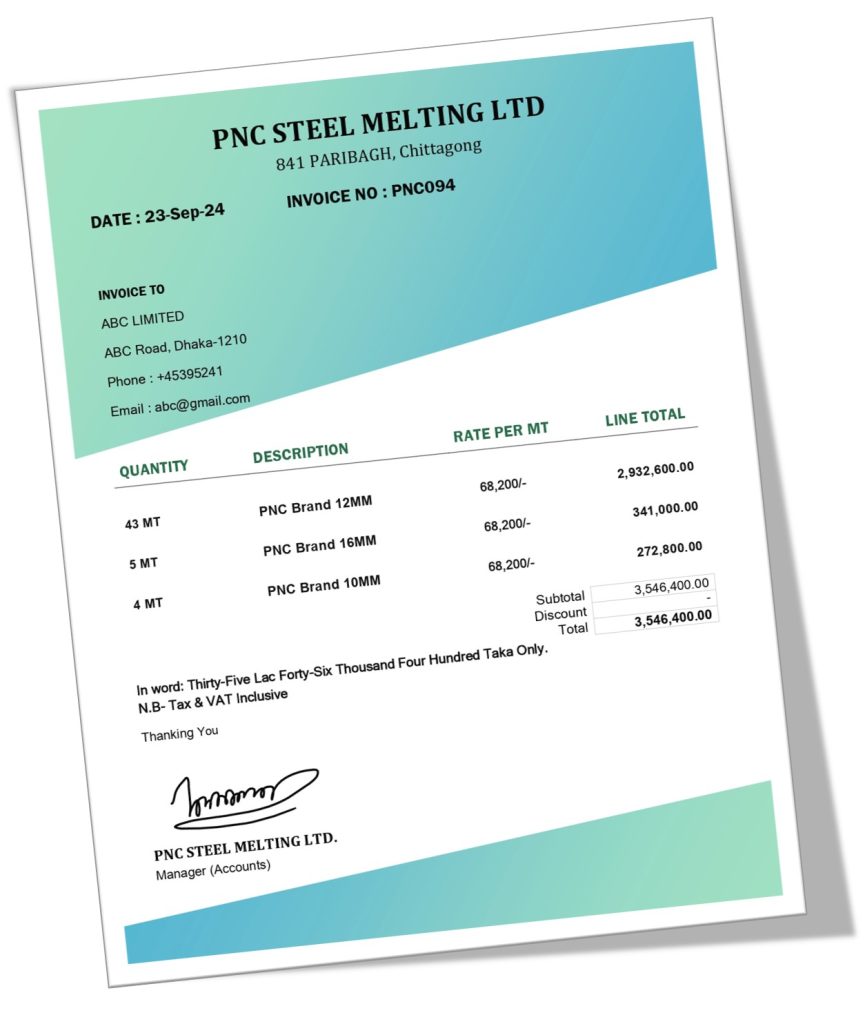

MS Scrap Steel Bill

VAT Challan

Step-1 Calculate VAT Amount.

Bill Amount = tk. 3,546,400

VAT = 2,200 x 52 = tk. 114,400.

So, you must deduct VAT tk. 114,400.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 3,546,400 – 114,400

= tk. 3,432,000

Step-3 Calculate Tax Amount from Base Value.

Tax will deduct from this bill = Base Value x Tax Rate

= (3,432,000 – 0.50%)

= 17,160

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 3,432,000 – 17,160

= 3,414,840

Total payment amount from this bill tk. 3,414,840 after deducting TDS & VDS.

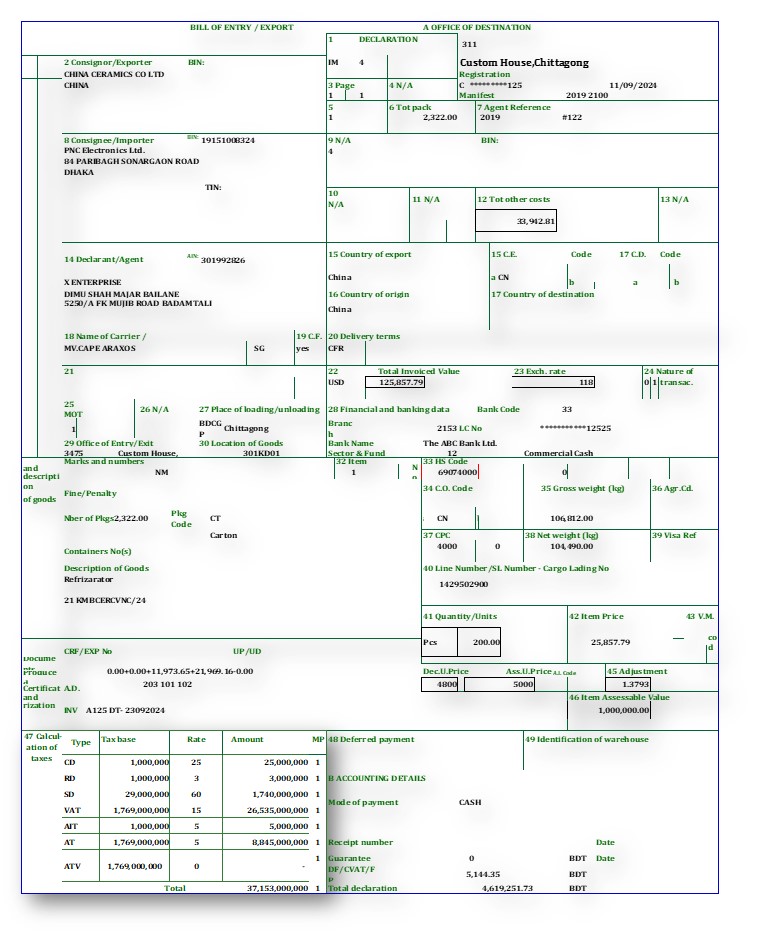

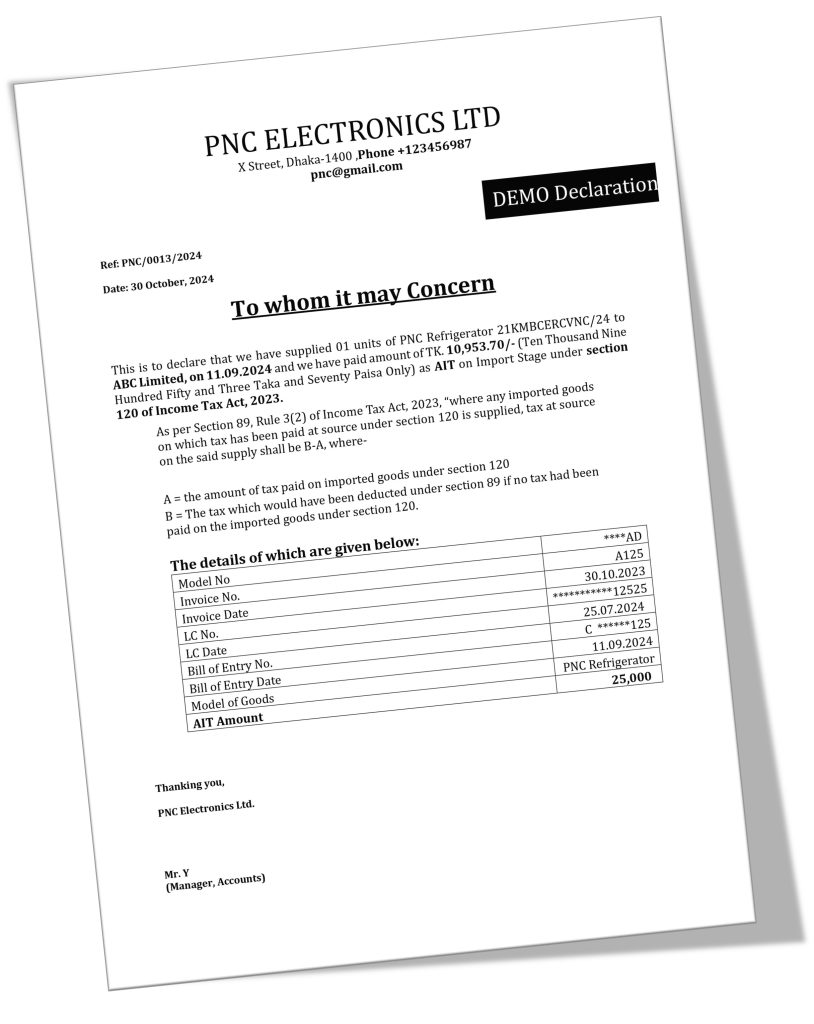

In which cases TDS will not deducted from imported goods?

where any imported goods on which tax has been paid at source under section 120 is supplied, tax at source on the said supply shall be B-A, where–

A = the amount of tax paid on imported goods under section 120

B = The tax which would have been deducted under section 89 if no tax had been paid on the imported goods under section 120.

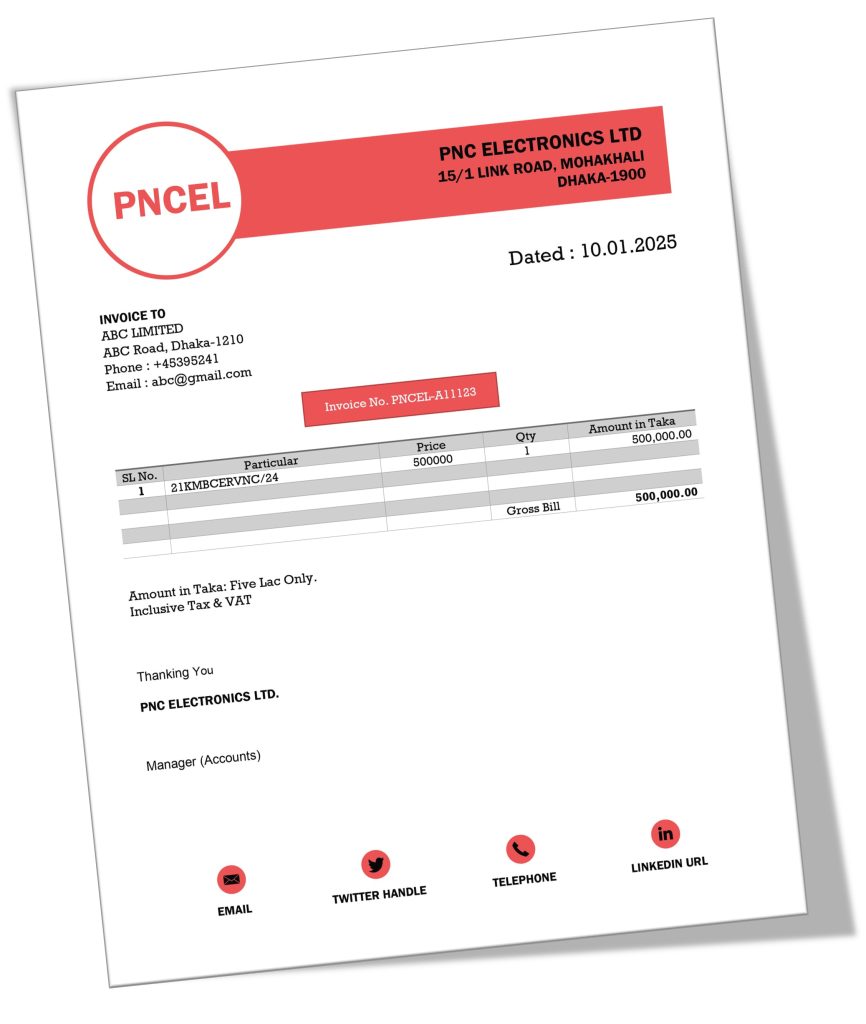

Bill Related Information

Bill Amount = 500,000

No. of Qty = 1

Term: Tax & VAT as per Government Policy

Imported goods supply without changing its shape.

Bill of Entry No. C ******125

Total AIT paid = 5,000,000 No. of Qty = 200

Calculation Process

At First, we have to find out VAT amount

Step-1 Calculate VAT Amount.

Bill Amount = tk. 500,000

VAT = 500,000 x 7.5/107.5 = tk. 34,884.

So, you must deduct VAT tk. 34,884.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 500,000 – 34,884.

= tk. 465,116

Step-3 Calculate Tax Amount from Base Value.

Tax = Base Value x Rate of Tax

= 465,116 x 5%

= tk. 23,256

This amount will be treated as B= the amount of tax applicable under this section if no tax were paid under section 120 = tk. 23,256

Now we have to calculate “A= the amount of tax paid under section 120” from bill of entry

Bill of Entry No. C ****125

Total AIT paid = 5,000,000

No. of Qty = 200

AIT paid per unit = 5,000,000/200 = tk. 25000 per unit.

No. of Selling qty = 1

Here A= the amount of tax paid under section 120 = tk. 25,000

B-A = 23,256 – 25,000 = (1744)

So, TDS Deduction not required

[N.B: You have to Submit Declaration for Imported Goods Sales on your Company Pad]

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 465,116 – 0

= tk. 465,116

Total payment amount from this bill tk. 465,116 after deducting TDS & VDS.

How to deduct tax if the goods are supplied by the dealer / distributor / supplier under section 94?

Where any goods on which tax has been paid at source under section 94 is supplied, tax at source on the said supply shall be B-A, where-

A = the amount of tax paid under section 94

B = The tax which would have been deducted under section 89 if no tax had been paid on the imported goods under section 94

“Provided that in case of the goods supplied by any distributor or any other person under a contract as referred in sub-section (3) of section 94, the term “B” as mentioned in paragraph (d) shall be computed as follows:

B = {the selling price of the company to the distributor or the other person as referred in section 94} x 7% x 5%.

Bill Related Information

Bill Amount = 500,000

Trade Discount @ 5%

Distributor Discount @ 20%

Term: Tax & VAT as per Government Policy

Calculation Process

At First, we have to find out VAT amount

Step-1 Calculate VAT Amount.

Bill Amount = tk. 500,000

VAT = 500,000 x 7.5/107.5 = tk. 34,884.

So, you must deduct VAT tk. 34,884.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 500,000 –34,884.

= tk. 465,116

Step-3 Calculate Tax Amount from Base Value.

Tax = B = {the selling price of the company to the distributor or the other person as referred in section 94} x 7% x 5%.

Tax = Base Value x Rate of Tax

= 465,116 x 7% x 5%

= tk. 1,628

This amount will be treated as B = the amount of tax applicable under this section if no tax were paid under section 94 = tk. 1,628

Now we have to calculate “A = the amount of tax paid under section 94” from bill of entry

TDS as per 94 = A = Selling price Distributor after VAT x 5% x 5%

Tax = Base Value x Rate of Tax

= 465,116 x 5% x 5%

= tk. 1,163

Here A = the amount of tax paid under section 94 = tk. 1,163

B-A = 1,628 – 1,163 = tk. 465 tax.

So, TDS required for Deduction

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 465,116 – 465

= 464,651

What will do if payee fails to submit proof of submission of return at the time of making the payment?

If payee fails to proof submission of return at the time of making the payment, the rate of tax shall be fifty percent (50%) higher.

If you face any problem to calculate Tax & VAT, Share it with us in the comments!