Welcome everyone to our latest blog post on the topic of calculating Tax and VAT on transport services. In today’s world, transportation is an essential part of our daily lives, whether it be for commuting to work or traveling for leisure. However, many of us may not be aware of the various Taxes and VAT that are applicable when it comes to transportation services.

In this blog post, we will delve into the Bangladesh of transportation Taxes and VAT, and explore how they are calculated. We will cover everything from the different types of transportation services that are subject to Tax and VAT, to the formulas used to calculate them.

If you are a business owner, a transportation service provider, or just someone who wants to gain a deeper understanding of how Taxes and VAT are applied to transportation services, then this blog post is for you.

So, get ready to learn everything you need to know about calculating tax and VAT on transport services. And without further ado, let’s dive right in!

What is Transport Service?

Transport service refers to the movement of goods or people from one location to another using different modes of transportation such as cars, buses, trains, ships, and planes. It is an essential component of modern life, enabling individuals and businesses to access goods, services, and opportunities that may be located far away.

Discuss the Types of Transport Services in Bangladesh?

Transport services can be provided by both public and private entities, with public transport services often being operated by government bodies or local authorities, while private transport services are operated by businesses and individuals. Some common types of transport services include:

Public transport services such as buses, trains, and subways that are designed to move large numbers of people within and between cities.

Private transport services such as taxis, ride-sharing services, and private car hire services that provide individuals with more flexible and personalized transportation options.

Freight transport services such as shipping and logistics companies that move goods between different locations using various modes of transportation, including trucks, trains, ships, and planes.

In the term of law

এস ০৪৮.০০ পরিবহন ঠিকাদারঃ

“পরিবহন ঠিকাদার” অর্থ এমন কোনো ব্যক্তি, প্রতিষ্ঠান বা সংস্থা যিনি বা যাহারা বানিজ্যিক ভিত্তিতে পণের বিনিময়ে কোনো সরকারি, আধা-সরকারি, স্বায়াত্তশাসিত প্রতিষ্ঠান, বেসরকারি সংস্থা (এনজিও), ব্যাংক, বীমা, বা অন্য কোনো আর্থিক প্রতিষ্ঠান, লিমিটেড কোম্পানিতে, তালিকাভুক্ত হউক বা না হউক, পণের বিনিময়ে যে কোনো পণ্য পরিবহনপূর্বক গন্তব্যস্থলে পৌছানোর দায়িত্ব পালন করেন।

“Transport Contractor” means any person, firm or organization who, on a commercial basis, engages in exchange of goods with any Government, Semi-Government, Autonomous Institution, Non-Government Organization (NGO), Bank, Insurance, or any other financial institution, remitted company, Whether or not, in exchange for money, he carries out the responsibility of transporting any product to the destination.

এস ০৮০.০০ রাইড শেয়ারিংঃ

“রাইড শেয়ারিং” অর্থ কোনো ইন্টারনেট বা ওয়েব বা অনলাইন প্লাটফর্ম বা মোবাইল বা অন্য কোনো ইলেক্ট্রনিক অ্যাপ্লিকেশন ব্যবহার করিয়া ব্যক্তি মালিকানাধীন মোটরযানের মাধ্যমে প্রদত্ত কোনো যাত্রী পরিবহন সেবা।

“Ride Sharing” means any passenger transportation service provided by a privately owned motor vehicle using any internet or web or online platform or mobile or any other electronic application.

Does Tax & VAT charge on Transport Service?

Yes, Taxes and Value Added Tax (VAT) are applicable to transport services in Bangladesh. The National Board of Revenue (NBR) is responsible for collecting taxes on various goods and services, including transport services.

Who are withholding authority to deduct VAT & Tax on Transport Service?

VAT Reference:

S.R.O No.240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b)

Withholding authority are Any Government or any Ministry thereof, department or office, any semi-public or autonomous body, State-owned enterprises, local authorities, council or any similar body, non-governmental organizations approved by the Bureau of NGO Affairs or Department of Social Services, Any bank insurance company or similar financial institution, Secondary or higher education institutions and a limited company;

Tax Reference:

Income Tax Ordinance 1984, Section 52AA specified person shall have the same meaning as in clause (a) of sub section (2) of section 52

In this section-

(a) the specified person means-

(i) the Government, or any authority, corporation or body of the Government, including its units, the activities of which are authorized by any Act, Ordinance, Order or instrument having the force of law in Bangladesh;

(ii) a project, program or activity where the Government has any financial or operational involvement;

(iii) a joint venture or a consortium;

(iv) a company as defined in clause (20) of section 2 of this Ordinance;

(v) a co-operative bank;

(vi) a co-operative society;

(vii) a financial institution;

(viii) a Non-Government Organization registered with the NGO Affairs Bureau or a Micro Credit Organization having license with Micro Credit Regulatory Authority

(ix) a school, a college, an institute or a university;

(x) a hospital, a clinic or a diagnostic center;

(xi) a trust or a fund;

(xii) a firm;

(xiia) an association of persons

(xiii) a public-private partnership;

(xiv) a foreign contractor, a foreign enterprise or an association or a body established outside Bangladesh;

(xv) Any e-commerce platform, not being any other specified person, called by whatever name having annual turnover exceeding taka one crore; and

(xvi) hotel, resort, community center and transport agency having annual turnover exceeding Taka one crore

(xvii) an artificial juridical person

What is the VAT & Tax rate for Transport Service?

| VAT | Rate | Tax | Rate |

| Service Code: S048.00 Transport Contractor (In case of petroleum) Transport Contractor (In other case) | 5% 10% | Section 52AA 13(i) Transport Service | 5% |

| Service Code: S080.00 Ride Sharing Service | 5% | Section 52AA 13(i) Ride Sharing Service | 5% |

How to calculate Tax & VAT on Transport Service?

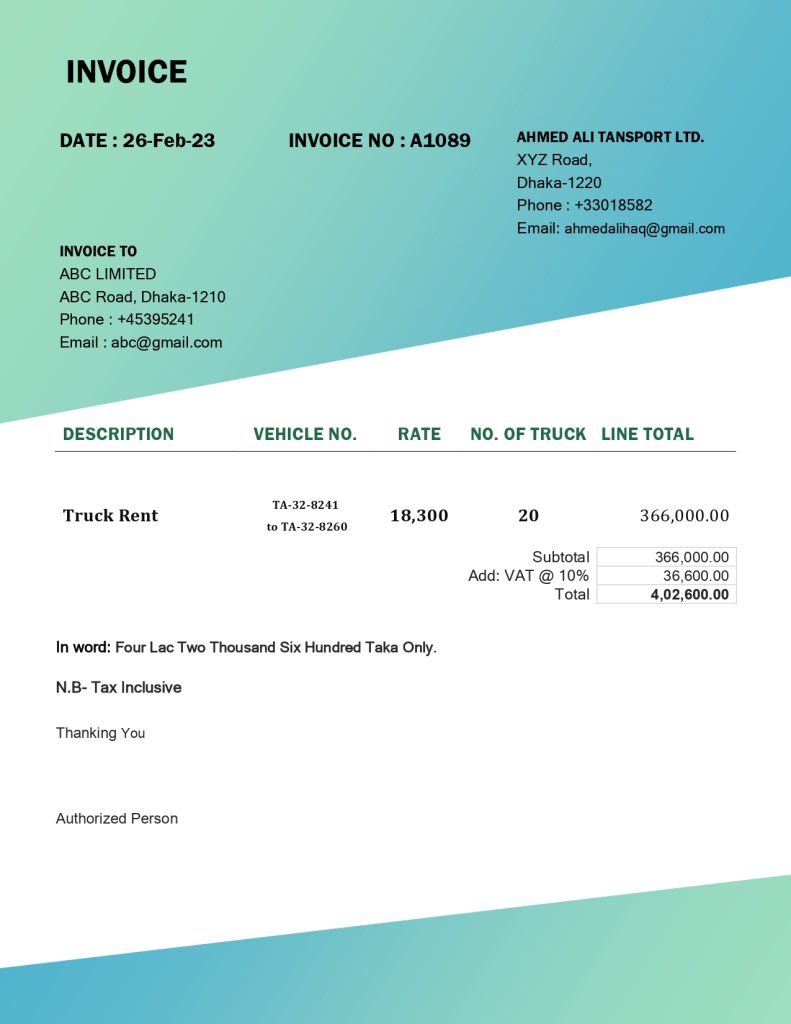

Transport Service-Related Bill (In any other case)

Calculation process

Step-1 Calculate VAT Amount.

Bill Amount = tk. 402,600

VAT = 402,600 x 10/110 = tk. 36,600.

So, you must deduct VAT tk. 36,600.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 402,600 – 36,600

= tk. 366,000

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 366,000 x 5%

= 18,300

[N.B- It is assumed that Proof of Submission of Return (PSR) duly submitted by service provider. If PSR not submitted to withholding authority then tax rate will be 50% higher.]

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 366,000 – 18,300

= tk. 347,700

Total payment amount from this bill tk. 347,700 after deducting TDS & VDS.

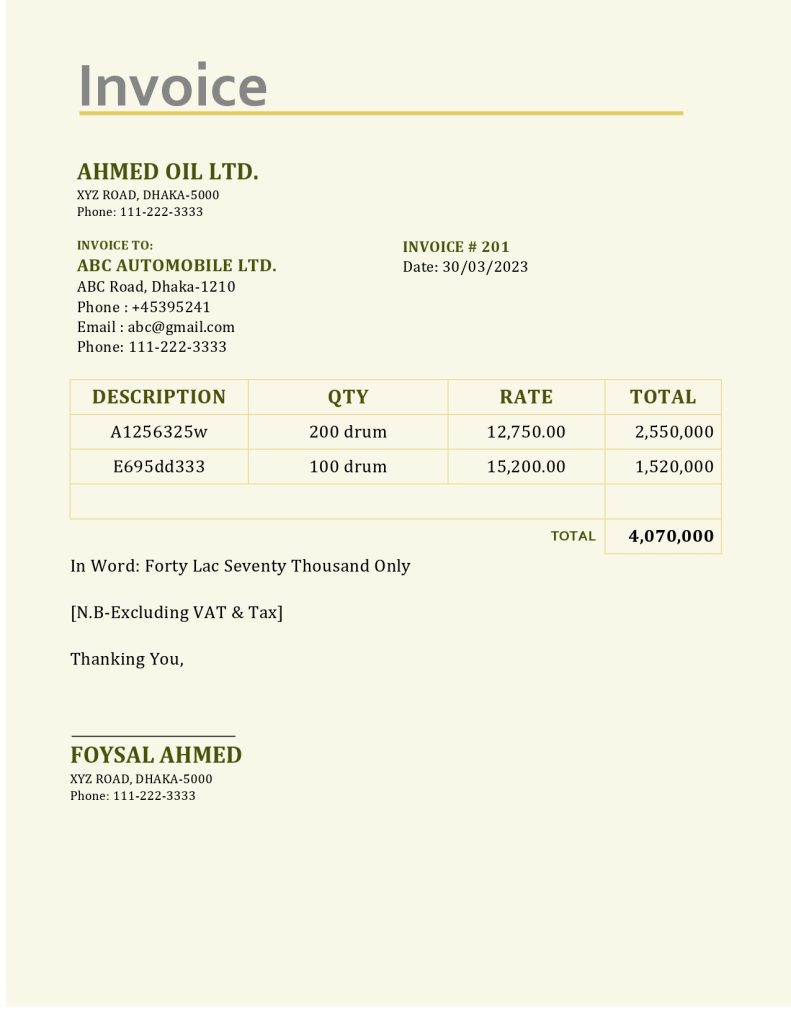

Transport Service-Related Bill (In case of petroleum product)

Calculation process

Step-1 Tax Amount Calculated on Gross up Method:

Above mention bill included a term “Exclusive VAT & Tax”. If any bill attached above term, you should calculate Tax amount on gross up method.

Here

Bill Amount = Payment Amount

Payment Amount = tk. 4,070,000

Tax = Payment Amount x Tax Rate/(100-Tax Rate)

= 4,070,000 x 5/95 = tk. 214,210

So, you must deduct Tax tk. 214,210.

Step-2 Calculate Base Value.

Base Value = Payment Amount + Tax

= 4,070,000 + 214,210

= tk. 4,284,210

Or,

Base Value = Payment Amount x 100/ (100-Tax Rate)

= 4,070,000 x 100/ (100-5)

= 4,070,000 x 100/95

= tk. 4,284,210

Step-3 VAT Amount Calculate from Base Value.

VAT = Base Value x VAT Rate

= 4,284,210 x 5%

= tk. 214,210.

Step-4 Calculate Actual Bill Amount.

Actual Bill Amount = Base Value + VAT

= 4,284,210 + 214,210

= tk. 4,498,420

Ride Sharing Service-Related Bill

Calculation process

Step-1 Calculate VAT Amount.

Bill Amount = tk. 204,750

VAT = 204,750 x 5/105 = tk. 9,750.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 204,750 – 9,750

= tk. 195,000

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 195,000x 5%

= 9,750

Step-4 Calculate Payment Amount.

Payment = (Base Value + VAT) – Tax

= (195,000+9,750)– 9,750

= tk. 195,000

Here Ride sharing service not included in the VDS S.R.O No.240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b) . So, VAT amount must be payment to the Ride sharing service provider

Total payment amount from this bill tk. 195,000 after deducting TDS.

what will do if payee fails to submit proof of submission of return at the time of making the payment?

- The rate of tax shall be fifty percent (50%) higher if the payee fails to submit proof of submission of return at the time of making the payment;

- The rate of tax shall be fifty percent (50%) higher if the payee does not receive payment by bank transfer;

If you face any problem to calculate Tax & VAT, Share it with us in the comments!