“Professional services, such as consulting, engineering, legal advisor, architect, interior designer or accounting, are subject to Tax & Value Added Tax (VAT) in many countries. If you provide professional services, it’s important to understand how VAT & Tax works and how to calculate it accurately on your invoices. In this guide, we’ll walk you through the process of calculating Tax & VAT on professional services, including the steps for determining your Tax & VAT rate and the appropriate Tax & VAT treatment for your services.”

Here the question is What is Professional Service? Does Tax & VAT charge on Professional Service? Who are withholding authority to deduct VAT & Tax on Professional Service? What is the VAT & Tax rate for Professional Service? How to calculate Tax & VAT on Professional Service? what will do if payee fails to submit proof of submission of return at the time of making the payment?

I will help you answer all these question in this post. You’ll get a practical insight on how to calculate Tax & VAT on Professional services. Just follow & understand the Tax & VAT implications on professional service. A Step-by-Step Guide to Calculating the Right Amount. Let’s start.

What is Professional Service?

Professional services refer to a range of services. It is typically provided by individuals or companies who have specialized knowledge, education, and experience in a particular field. Examples of professional services include consulting, accounting, engineering, legal services, marketing, and architecture.

Legal Advisor refers to a person, legal expert, or group of legal experts who are part of a chamber or organization. He provides legal advice and assistance to individuals or companies on matters related to laws, legal procedures, or other legal issues. They may provide this advice directly or through representation in court or other legal proceedings in exchange for money.

Audit and Accounting Firm is a professional organization. They provide a wide range of financial and accounting services to businesses and organizations. These services may include auditing financial statements, preparing financial statements, providing tax advice, and offering consulting services. The firm may be composed of certified public accountants (CPAs), chartered accountants (CAs), or other financial experts with the knowledge and skills to provide these services. The firm may also provide internal audit, financial due diligence, and other assurance services.

Graphic Designer is a professional who uses design elements such as typography, photography, illustration, and color to create visual representations of information and ideas. They work to create a variety of visual materials such as brochures, posters, logos, websites, packaging, and more. Graphic designers use software such as Adobe Photoshop, Illustrator, and InDesign to create digital designs and layouts. They also use visual arts, typography, and page layout techniques to produce designs that are both functional and appealing. Graphic designers work in a variety of industries, including advertising, marketing, web design, print and publishing.

Architect is a professional who designs and plans the construction of buildings and other structures. They consider factors such as safety, function, and aesthetic appeal when creating their designs. Architects work closely with engineers, construction professionals, and other design specialists to ensure that their designs are feasible, compliant with building codes, and compatible with the surrounding environment.

Interior Designer is a professional who designs the interior spaces of buildings, such as homes, offices, and commercial spaces.

Does Tax & VAT charge on Professional Service?

In Bangladesh, Tax & VAT are integral part of professional service. It is also a revenue sources of government revenue. Every professional service bill is subject to VAT & Tax applicable on any platform.

Who are withholding authority to deduct VAT & Tax on Professional Service?

VAT Reference:

S.R.O No.240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b) Withholding authority are

- Any government or any of its ministries

- Department,

- A semi-public or autonomous body

- State-owned enterprises

- Local authorities

- Council or similar body

- Non-governmental organizations approved by the Bureau of NGO Affairs or the Department of Social Services

- Any bank, insurance company or similar financial institution

- Secondary or higher-level educational institutions and

- limited company

Tax Reference:

Income Tax Act 2023, Section-104 (3)

The Specified person means-

(a) any company, firm, association, trust or fund;

(b) Public-Private Partnership

(c) any foreign contractor, foreign enterprise or association or organization established outside Bangladesh;

(d) any hospital, clinic or diagnostic centre;

(e) any e-commerce platform having an annual turnover of more than one crore taka, other than any specified person, by whatever name called;

(f) hotels, community centers, transport agencies with an annual turnover of more than one crore taka;

(g) any person other than a farmer engaged in the production and supply of tobacco leaves, cigarettes, bidis, jorda, gul and other tobacco products;

What is the VAT & Tax rate for Professional Service?

| VAT | Rate | Tax | Rate |

| Service Code: S032.00 Consultancy & Supervisory Firm | 15% | Section 90 & Rule 4, SL No. 1 Professional service, technical services fee, technical assistance fee | 10% |

| Service Code: S034.00 Audit & Accounting Firm | 15% | Section 90 & Rule 4, SL No. 1 Professional service, technical services fee, technical assistance fee | 10% |

| Service Code: S045.00 Legal Advisor | 15% | Section 90 & Rule 4, SL No. 1 Professional service, technical services fee, technical assistance fee | 10% |

| Service Code: S050.00 Architect, Interior designer or Decorator | 15% | Section 90 & Rule 4, SL No. 1 Professional service, technical services fee, technical assistance fee | 10% |

How to calculate Tax & VAT on Professional Service?

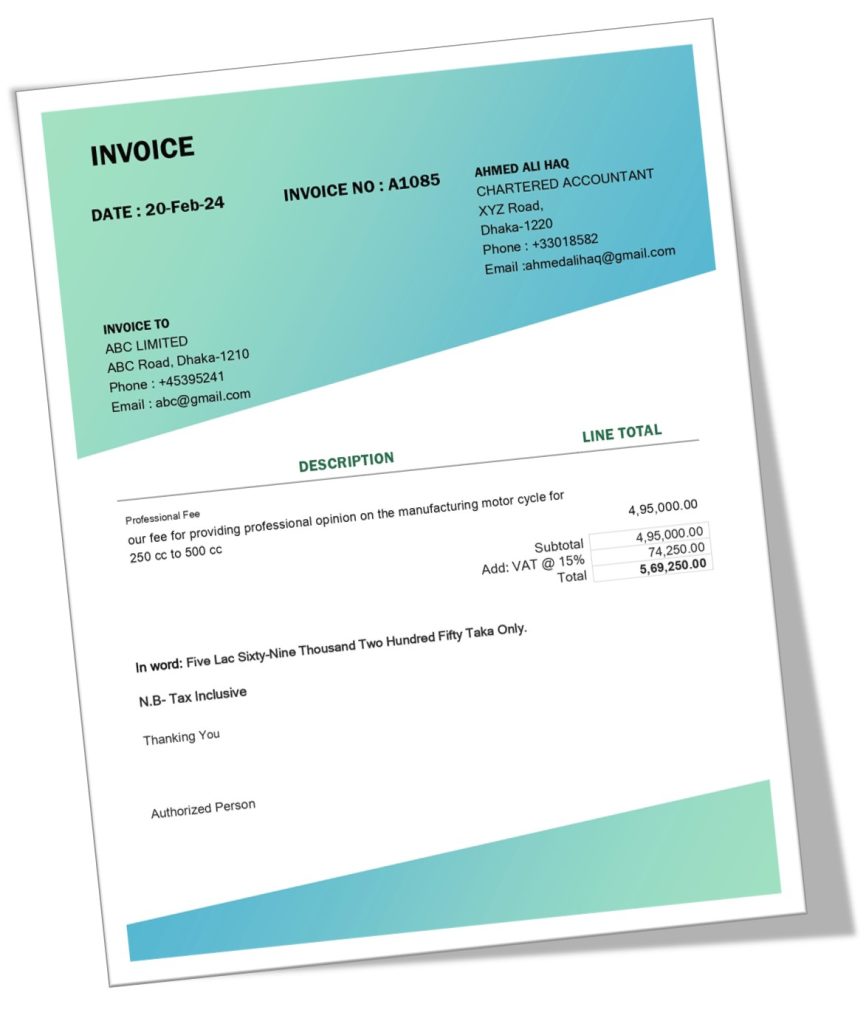

Professional Service-Related Bill

Calculation Process

Step-1 Calculate VAT Amount.

Bill Amount = tk. 569,250

VAT = 569,250 x 15/115 = tk. 74,250.

So, you must deduct VAT tk. 74,250.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 569,250– 74,250

= tk. 495,000

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 495,000x 10%

= 49,500

[N.B- It is assumed that Proof of Submission of Return (PSR) duly submitted by service provider. If PSR not submitted to withholding authority then tax rate will be 50% higher.]

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 495,000– 49,500

= tk. 445,500

Total payment amount from this bill tk. 445,500 after deducting TDS & VDS.

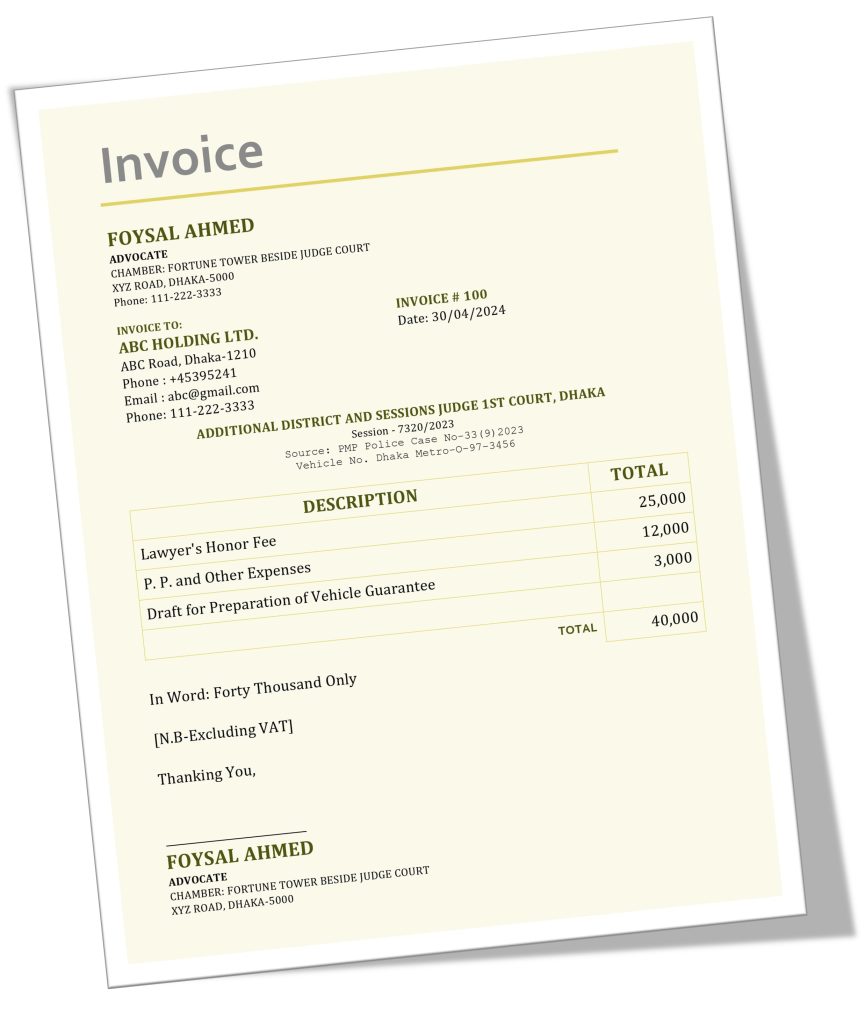

Legal Advisory Service-Related Bill

Calculation Process

Step-1 Calculate Tax Amount.

Here VAT Excluded means Bill Amount = Base Value

Bill Amount = Base Value = tk. 25,000

VAT = 25,000 x 15% = tk. 3,750.

So, you must deduct VAT tk. 3,750.

Step-2 Calculate Base Value.

Base Value = Bill Amount = 25,000

Actual Bill Amount = Base Value + VAT

= 25,000 + 3,750

= 28,750

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 25,000x 10%

= 2,500

[N.B- It is assumed that Proof of Submission of Return (PSR) not submitted by service provider. If PSR not submitted to withholding authority then tax rate will be 50% higher.]

Tax Amount = Base value x Rate of Tax

= 25,000x 15% [10% + 5% (10% x 50%)]

= 3,750

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 25,000– 3,750

= tk. 21,250

Total payment amount from this bill tk. 21,250 after deducting TDS & VDS.

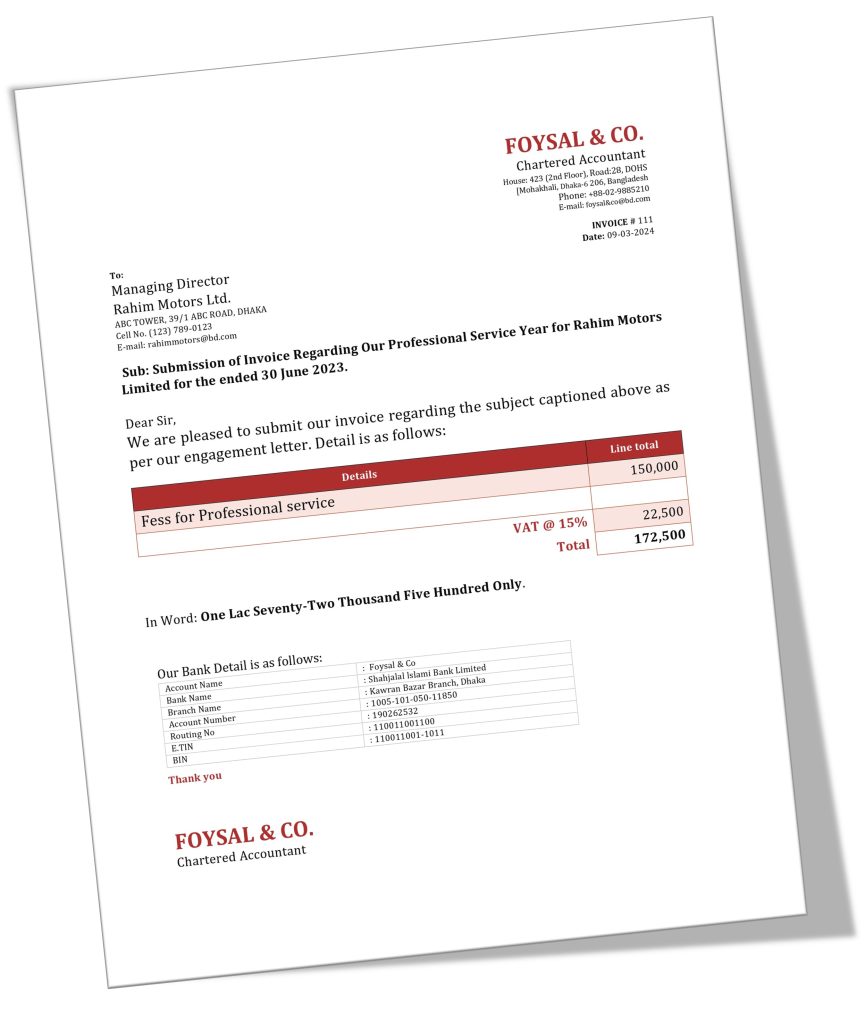

Audit & Accounting Service-Related Bill

Calculation Process

Step-1 Calculate VAT Amount.

Bill Amount = tk. 172,500

VAT = 172,500 x 15/115 = tk. 22,500.

So, you must deduct VAT tk. 22,500.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 172,500 – 22,500

= tk. 150,000

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 150,000x 10%

= 15,000

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 150,000–15,000

= tk. 135,000

Total payment amount from this bill tk. 135,000 after deducting TDS & VDS.

What will do if payee fails to submit proof of submission of return at the time of making the payment?

- The rate of tax shall be fifty percent (50%) higher if the payee fails to submit proof of submission of return at the time of making the payment;

- The rate of tax shall be fifty percent (50%) higher if the payee does not receive payment by bank transfer;

If you face any problem to calculate Tax & VAT, Share it with us in the comments!