Are you planning to rent a convention hall for your next event in Bangladesh? While you may have already considered the rental price, have you factored in the additional costs such as taxes and Value Added Tax (VAT)? These charges can significantly impact your overall event budget, so it’s crucial to understand how to calculate them accurately.

In this blog, we’ll provide you with a step-by-step guide on how to calculate Tax & VAT on Convention all rent in Bangladesh. By following our instructions, you can avoid any financial surprises and manage your event budget efficiently. So, let’s get started!

Define Service from Convention Hall, Conference Center?

Convention halls and conference centers are large event spaces designed to host various types of events such as conferences, trade shows, exhibitions, concerts, and other gatherings. These services may include:

1. Event planning and coordination

2. Technical support

3. Catering

4. Housekeeping and cleaning

5. Security and safety

In Bangladesh, the taxes and VAT calculation on service from convention hall and conference center services are regulated by the National Board of Revenue (NBR), which is the central authority for tax administration in the country.

In the term of law

এস ০১৭.০০ কম্যুনিটি সেন্টারঃ

“কম্যুনিটি সেন্টার” অর্থ বিবাহ, জন্মদিন, সেমিনার, সিম্পোজিয়াম বা অন্য কোনো সাংস্কৃতিক, সামাজিক বা রাজনৈতিক অনুষ্ঠান সম্পাদনের নিমিত্ত সাময়িকভাবে ভাড়া প্রদত্ত কোনো ভবন বা প্রাঙ্গণ এবং তদসংশ্লিষ্ট অনুষ্ঠান সম্পাদন সংক্রান্ত কার্যাবলির মধ্যে খাদ্য পরিবেশনও অন্তর্ভুক্ত হইবে।

এস ০০১.১০ হোটেলঃ

“হোটেল” অর্থ কোনো ক্লাবসহ, এমন কোনো ক্লাবসহ এমন কোনো প্রতিষ্ঠান, সংস্থা বা স্থান যেখানে সাময়িকভাবে অবস্থানের জন্য কোনো কক্ষ বা কক্ষসমূহের স্যুট বা অন্য কোনো ধরনের আবাসন, উহাতে ক্যাটারিং এর ব্যবস্থা অথবা যে কোনো নামে অভিহিত অন্য কোনো সেবা সুবিধা বা উপযোগিতার ব্যবস্থা থাকুক বা না থাকুক, ভাড়া দেওয়া হয় এবং ফ্লোর শো প্রদর্শনকারী কোনো প্রতিষ্ঠানও এই সংঙ্গার অন্তর্ভুক্ত হইবে ।

এস ০০১.২০ রেস্তোরাঁঃ

“রেস্তোরাঁ” অর্থ কোনো ক্লাবসহ, এমন কোনো প্রতিষ্ঠান, সংস্থা বা স্থান যেখানে অথবা যে কোনো নামে অভিহিত অন্য কোনো সেবা, সুবিধা বা উপযোগিতা প্রদান করা হউক বা না হউক, উহাতে বা অন্যত্র ভোগের উদ্দেশ্যে কোনো খাদ্য বা পানীয় বিক্রয় করা হয় এবং ফ্লোর শো প্রদর্শনকারী প্রতিষ্ঠানসহ যান্ত্রিক যানে পরিচালিত মোবাইল রেস্তোরাঁও ইহার অন্তর্ভুক্ত হইবে ।

Section-52P Service from Convention Hall, Conference Center etc.:

Where any payment is to be made by a specified person to another person on account of renting or using space of convention hall, conference center, room or, as the case may be, hall, hotel, community center or any restaurant, shall deduct tax at the rate of five per cent from the whole amount of the payment for the services thereof at the time of making such payment to the payee:

Provided that no deduction shall be made when such amount is paid directly to the Government.

Does Tax & VAT Charge on Community Center Bill?

Yes, Taxes and Value Added Tax (VAT) are applicable to Community Center Bill in Bangladesh. The National Board of Revenue (NBR) is responsible for collecting taxes on various goods and services, including Community Center Bill.

Who are withholding authority to deduct VAT & Tax on Community Center Service?

VAT Reference:

S.R.O No.240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b)

“উপরে উল্লেখ করা (এস.আর. ওনং–২৪0-আইন/২0২১/১৬৩–মূসক) টি এস. আর. ও. নং–১৭৯–আইন/ ২০২২–মূসক দ্বারা ২০২২–২০২৩ অর্থ বৎসরের জন্য সময়সীমা বৃদ্ধি করা হয় ও ২৪ অক্টোবর ২০২২ তারিখে এস. আর. ও. নং–৩২৫–আইন/ ২০২২/২০৬–মূসক দ্বারা কিছু বিধি সংযোজন করা হয়েছে।“

Withholding authority are Any Government or any Ministry thereof, department or office, any semi-public or autonomous body, State-owned enterprises, local authorities, council or any similar body, non-governmental organizations approved by the Bureau of NGO Affairs or Department of Social Services, Any bank insurance company or similar financial institution, Secondary or higher education institutions and a limited company;

- Service Code S017.00 for Community Center is not included in VDS S.R.O 240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b), therefore there is no requirement for VAT deduction.

- Service Code: S001.10 AC Hotel & Non-AC Hotel & Service Code: S001.20 Restaurant are included in VDS S.R.O 240-AIN/2021/163-VAT rule 2 of sub-rule (1)(b). VAT deduction are mandatory.

Tax Reference:

Specified person shall have the same meaning as in clause (a) of sub section (2) of section 52

In this section-

(a) the specified person means-

(i) the Government, or any authority, corporation or body of the Government, including its units, the activities of which are authorized by any Act, Ordinance, Order or instrument having the force of law in Bangladesh;

(ii) a project, program or activity where the Government has any financial or operational involvement;

(iii) a joint venture or a consortium;

(iv) a company as defined in clause (20) of section 2 of this Ordinance;

(v) a co-operative bank;

(vi) a co-operative society;

(vii) a financial institution;

(viii) a Non-Government Organization registered with the NGO Affairs Bureau or a Micro Credit Organization having license with Micro Credit Regulatory Authority

(ix) a school, a college, an institute or a university;

(x) a hospital, a clinic or a diagnostic center;

(xi) a trust or a fund;

(xii) a firm;

(xiia) an association of persons

(xiii) a public-private partnership;

(xiv) a foreign contractor, a foreign enterprise or an association or a body established outside Bangladesh;

(xv) Any e-commerce platform, not being any other specified person, called by whatever name having annual turnover exceeding taka one crore; and

(xvi) hotel, resort, community center and transport agency having annual turnover exceeding Taka one crore

(xvii) an artificial juridical person

What is the VAT & Tax rate for Community Center, Convention Hall & Conference Center?

| VAT | Rate | Tax | Rate |

| Service Code: S017.00 (VAT) Community Center | 15% | Section 52P Service from Convention Hall, conference center etc. | 5% |

| Service Code: S001.10 (VDS + VAT) AC Hotel Non-AC Hotel | 15% 7.5% | Section 52P Service from Convention Hall, conference center etc. | 5% |

| Service Code: S001.20 (VDS + VAT) Restaurant | 5% | Section 52P Service from Convention Hall, conference center etc. | 5% |

How to calculate Tax & VAT on Community Center Service?

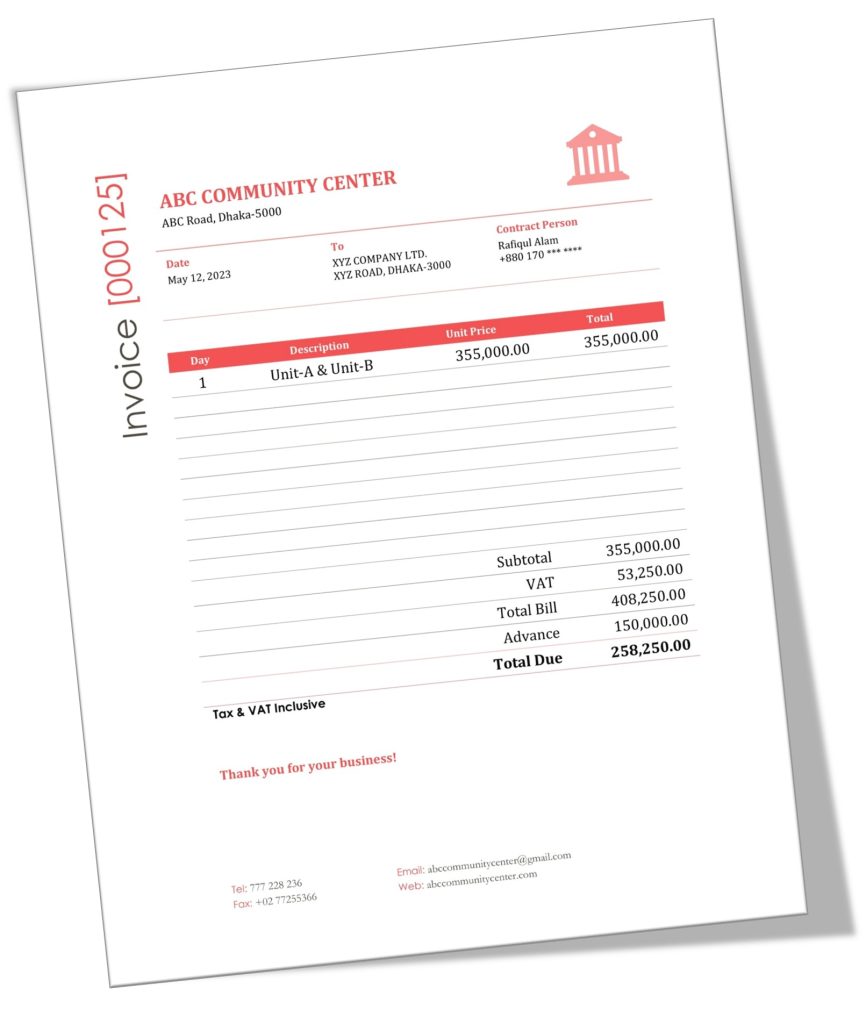

Community Center Bill

Calculation process

Step-1 Calculate VAT Amount.

Bill Amount = tk. 408,250

VAT = 408,250 x 15/115 = tk. 53,250.

Here VAT Amount tk. 53,250.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 408,250 – 53,250

= tk. 355,000

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 355,000 x 5%

= 17,750

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 355,000 – 17,750

= tk. 337,250

Total payment amount from this bill tk. (337,250 + 53,250) tk. 390,500 after deducting TDS.

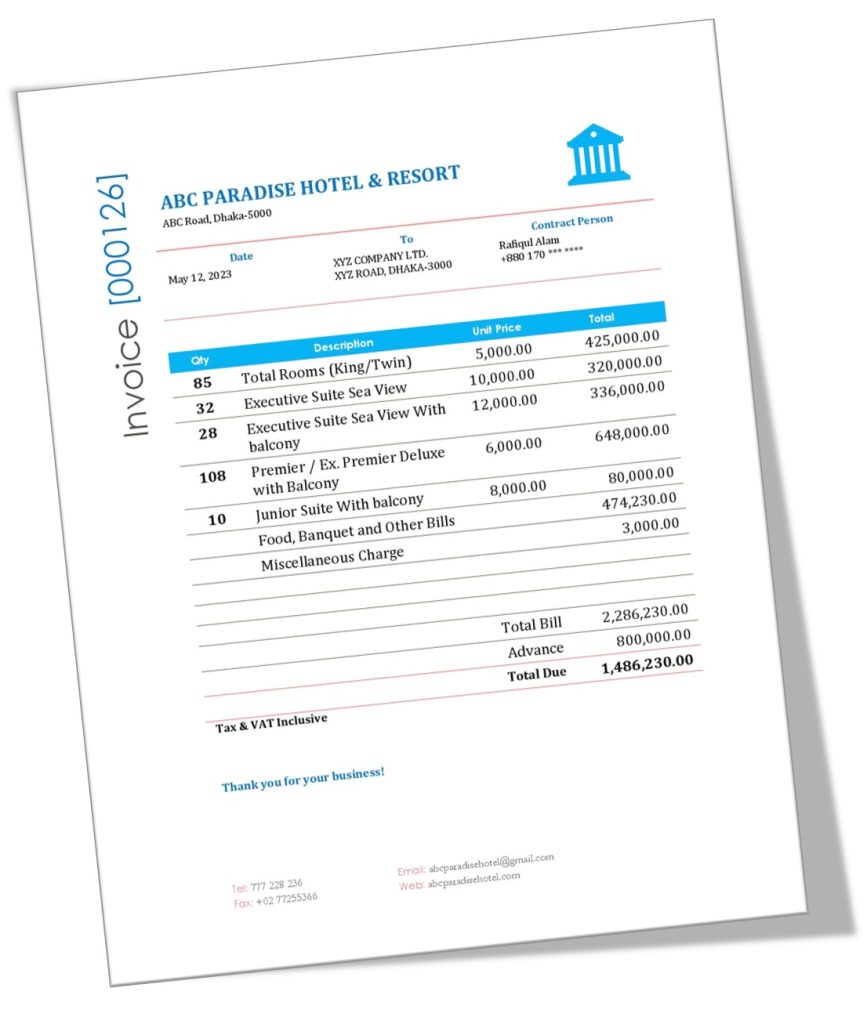

Hotel & Resort Bill

The above bill included food & accommodation. In practice it is found that some tax withholding authority consider this type of bill “Service from Convention Hall, conference center etc.” & some tax withholding authority allocate this bill separately such as food bill consider as Catering Service & Hotel bill consider as House Property Rent.

In this case we will provide two calculations process. You can practice anyone.

Calculation process-1

Step-1 Calculate VAT Amount.

Bill Amount = tk. 2,286,230

VAT = 2,286,230 x 15/115 = tk. 298,204. (It is considered AC Hotel)

So, you must deduct VAT tk. 298,204.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 2,286,230 – 298,204

= tk. 1,988,026

Step-3 Calculate Tax Amount from Base Value.

Tax Amount = Base value x Rate of Tax

= 1,988,026x 5%

= 99,401

Step-4 Calculate Payment Amount.

Payment = Base Value – Tax

= 1,988,026– 99,401

= tk. 1,888,625

Total payment amount from this bill tk. 1,888,625 after deducting VDS & TDS.

Calculation process-2

Step-1 Calculate VAT Amount.

Bill Amount = tk. 2,286,230

VAT = 2,286,230 x 15/115 = tk. 298,204. (It is considered AC Hotel)

So, you must deduct VAT tk. 298,204.

Step-2 Calculate Base Value.

Base Value = Bill Amount – Value Added Tax

= 2,286,230 – 298,204

= tk. 1,988,026

Here Tax Base value need to allocate Catering Service & House Property Rent.

Above mention bill

Food & Miscellaneous Charge Tk. (474,230+3,000) = Tk. 477,230 &

House rent Tk. (2,286,230 – 477,230) = Tk. 1,809,000

Food & Miscellaneous Charge Base Value = Bill Amount – Value Added Tax

= 477,230 – 62,247 (477,230 x 15/115)

= tk. 414,983

House Rent Base Value = Bill Amount – Value Added Tax

= 1,809,000 – 235,957 (1,809,000 x 15/115)

= tk. 1,573,043

Step-3 Calculate Tax Amount from Base Value.

Food & Miscellaneous Charge Tax Amount = Base value x Rate of Tax

= 414,983x 2%

= 8,300

(Catering Service Tax rate 2% on Gross Bill US-52AA 3(i))

House Rent Tax Amount = Base value x Rate of Tax

= 1,573,043 x 5%

= 78,652

(House Property Tax rate 5% US-53A)

Step-4 Calculate Payment Amount.

Food & Miscellaneous Charge Payment = Base Value – Tax

= 414,983– 8,300

= tk. 406,683

House Rent Payment = Base Value – Tax

= 1,573,043 – 78,652

= tk. 1,494,391

Total payment amount from this bill tk. (406,683 + 1494391) Tk. 1,901,074.

If you face any problem to calculate Tax & VAT, Share it with us in the comments!

Can you please share a VAT 4.3 declaration for service providers namely hotels, restaurants, catering, etc. similar services?