In recent time a question raises by most of the Business organization “Will the fund required to file tax return?” Answer: Yes, in 2022, Provident Fund, Gratuity Fund & Workers Profit Participation Fund were exempted from filling tax return. The Income Tax Act 2023 has eliminated the provision found in section 166(2).

So, Fund required to submit Income tax return.

What will be the tax rate of Fund?

The tax rate of fund will be 27.5% or 30% Subject to compliance some condition.

(a) All income and receipts shall be made through banking channels.

(b) Every single transaction exceeding 5 (five) lacs of taka shall be made through banking channels

(c) All expenses and investments above the total of 36 (thirty-six) lakhs of taka per annum shall be made through bank transfer.

If any fund fails to compliance above mentioned condition, the tax rate will be 30%.

Starting from December 6, 2023, a new tax rate of 15% will apply to Recognized Provident Funds, Approved Gratuity Funds, Approved Superannuation Funds, and Approved Pension Funds.–SRO No-333-AIN/Income Tax-20/2023

Will they be required to submit an audited financial statement?

A fund must file an audited financial statement if turnover exceeds taka. 3 Crore. (As per Income Tax Act 2023 Section 73).

As per Financial Reporting Council Letter no. 179/FRC/FRM/Notification/2020/02 Dated:15-July-2020, A recognised provident fund must file an audited financial statement within 120 days after end of financial year.

In the interest of transparency, a fund may submit an audited financial statement along with its tax return.

What is DVC number?

ICAB has developed the DVS ensuring the data security and confidentiality of the clients. It will be made mandatory for all practicing Chartered Accountants to register with the DVS Portal and to generate Document Verification Certificate (DVC). If any deviation, audit reports and financial statements signed by them would not be accepted by the regulators and other stakeholders. Source-ICAB Web Site

Here Given a Demo Document Verification Certificate

DVC: 230928**12AS****12

23 = Year

09 = Month

28 = Date

**12 = Chartered Accountants Enrolment Number

AS = Audited Statement

****12 = Certificate Number

What will be the Income Year of fund?

Fund Income Year will be July to June next as per income year definition.

Will funds be required to pay advance income tax?

If Fund income exceeds tk. 6 lac, need to advance tax on the date of 15 September, 15 December, 15 March, 15 June. Rest of tax will be payable on 30 November.

How to conduct provident fund audit?

At first, we need to prepare provident fund accounts such as Statement of Financial Position, Statement of Income and Expenditure, Notes to the financial statement, Schedule of Members Fund, Schedule of Payable for outgoing members.

Next step, we appoint a CA Firm to conduct a provident fund audit. CA Firm conduct provident fund audit as per International Standards of Auditing. International Accounting Standards, International Financial Reporting Standards & follow Financial Reporting Council guidance, Income tax law etc. After completion of audit CA Firm provide an opinion on the basis of evidence obtain & create a Document Verification Certificate (DVC) in the DVS Portal. DVC Number also mention in the audit opinion, Statement of Financial Position & Statement of Income and Expenditure.

Following the receipt of an audit report, it is required to submit this report to the Financial Reporting Council (FRC) within a period of seven days.

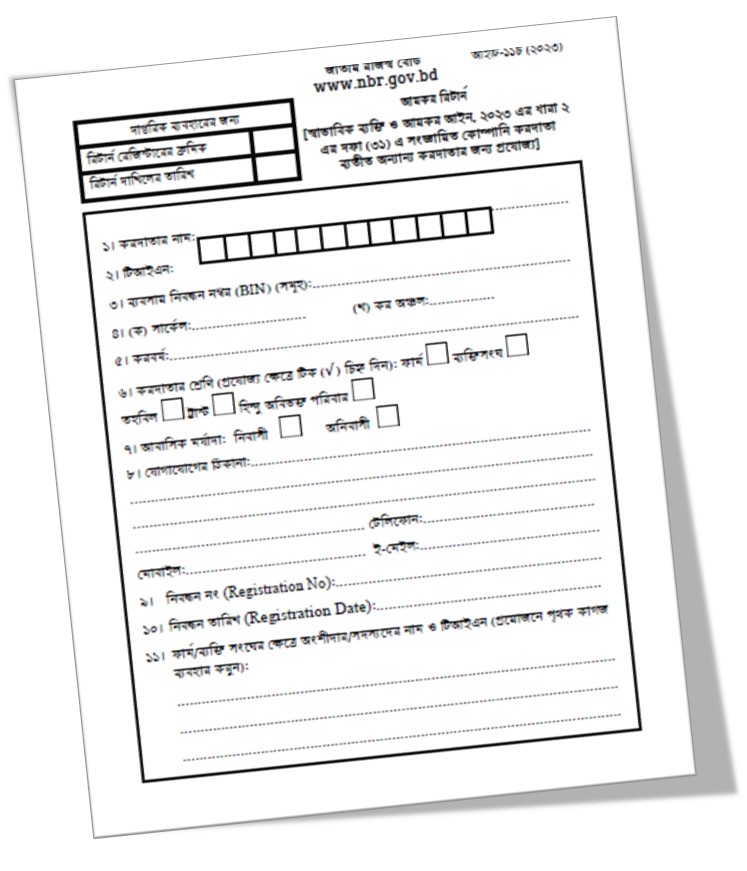

Which return form required to file provident fund income tax return?

In accordance with Statutory Regulatory Order (S.R.O.) No. 266-AIN/Income Tax-10/2023, which outlines the Income Tax Return Filing Rules 2023, the designated form IT 11CHA 2023

How to file provident fund income tax return?

In the first page of return the following information required:

1. Name of Assessee:

2. TIN:

3. Business Registration Number (BIN) (s):

4. (a) Circle:

(b) Tax Zone:

5. Tax Year:

6. Category of Taxpayer (Tick (√) if applicable):

- Firm

- An association of person

- Fund

- Trust

- A Hindu Undivided Family

7. Residential Status:

- Resident

- Non-Resident

8. Address:

- Telephone:

- Mobile:

- e-Mail:

9. Registration No:

10. Registration Date:

11. Name and TIN number of partners/members in case of firm/individual association (use separate paper if necessary):

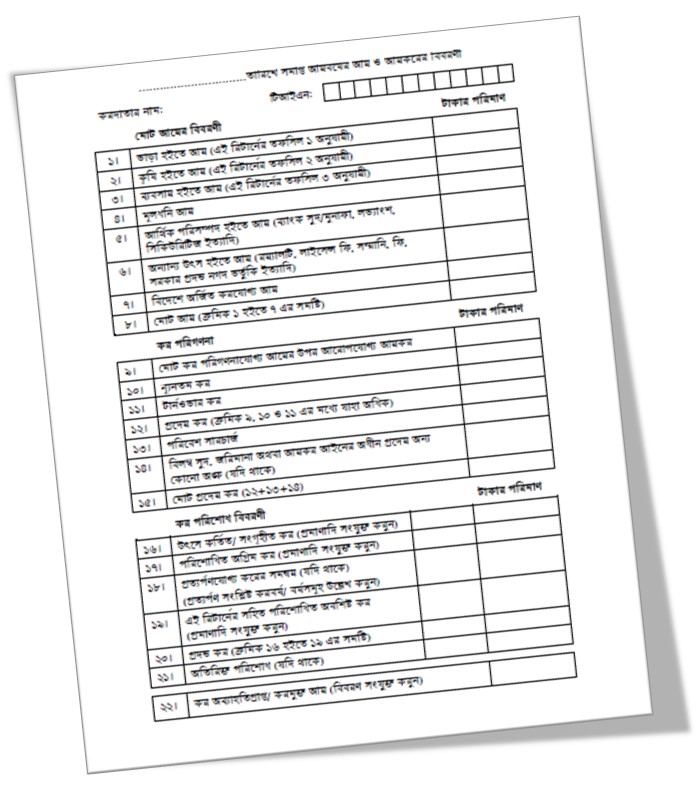

In Second page we need income details, Tax liabilities details & Tax payment related details. Separate calculation page needs to attached with return form. For more details see the video.

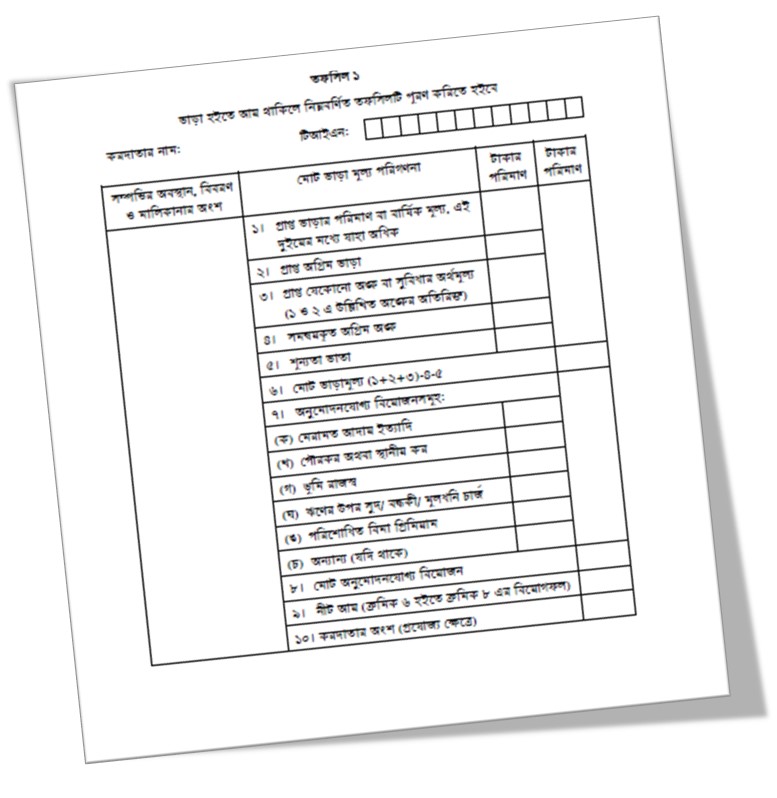

Provide Income from rent details (if any) in Schedule 1

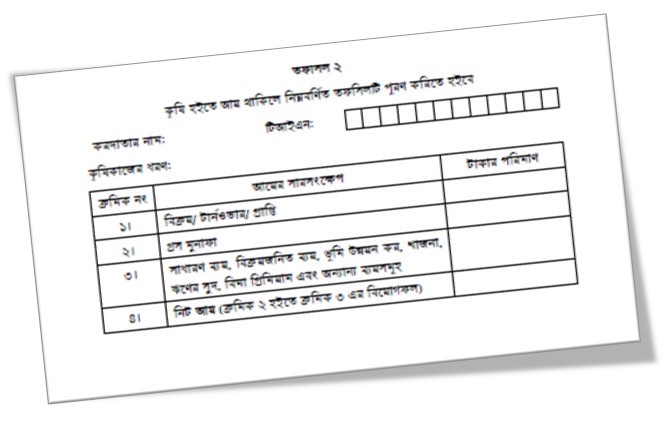

Provide Income from Agriculture details (if any) in Schedule 2

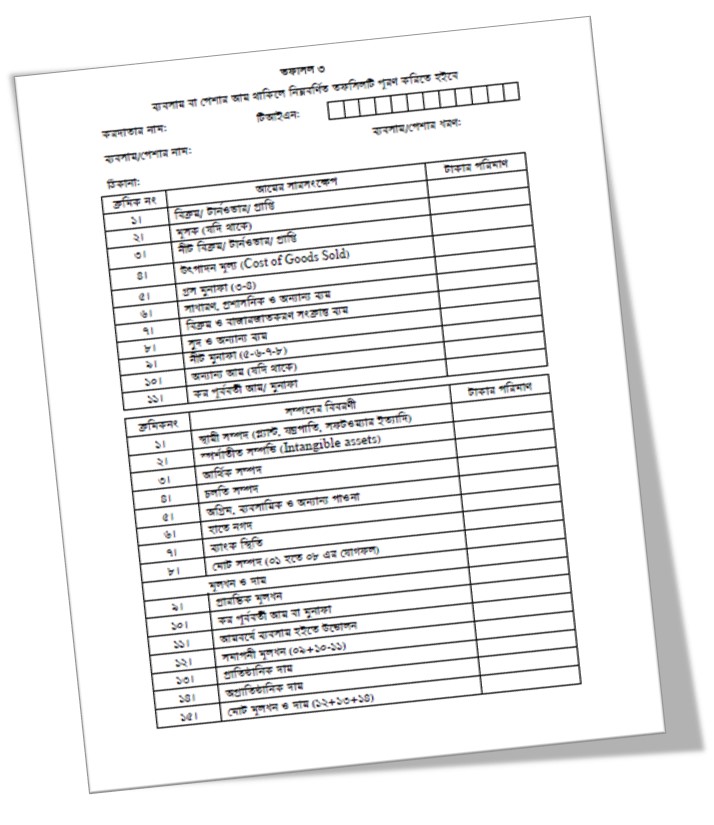

Provide Income from Business details (if any) in Schedule 3

Mention supporting details, calculation sheet, Income tax proof & others document (if any) in last page.

Here we are providing Tax related service, for more please contact below mention number.

1.Foysal Ahmed, Professional Level, RAT of ICAB, Cell Phone No.01815096221

2.Md. Azgar Ali, ITP, Cell Phone No.01725 646 918

3.Ikram Uddin Ahmed,ITP Cell Phone No.01823 223 344

4.Abedin Kader,ITP, CA(Course Completed), Cell Phone No.01717 703 783

FM SKILL SHARING

Partnership Firm Tax Return

**********************************************

ফাইলের নামঃ পার্টনারশীপ ফার্মের আয়কর রিটার্ন (বাংলা ভার্সন)

ফর্মঃ আইটি–১১চ (২০২৩)

*মূল্যঃ ৬০০ টাকা মাত্র*

**********************************************

File Name: Partnership Firm Income Tax Return (English Version)

Form: IT11GA (2023)

*Price Tk. 600 only*

**********************************************

This is a Compact File. (Auto Individual Tax Return)

Income Tax Return Format

**********************************************

ফাইলের নামঃ ব্যক্তিগত আয়কর রিটার্ন (বাংলা ভার্সন)

ফর্মঃ আইটি–১১গ (২০২৩)

*মূল্যঃ ৬০০ টাকা মাত্র*

**********************************************

File Name: Individual Income Tax Return (English Version)

Form: IT11GA (2023)

*Price Tk. 600 only*

**********************************************

Send Money This Number & also send a SMS with Bikas or Nagad Transaction Id & you mail no. Bikas No.01815 096 221

Withholding Tax Return

**********************************************

ফাইলের নামঃ উইথহোল্ডিং ট্যাক্স রিটার্ন (বাংলা ভার্সন)

*মূল্যঃ ৬০০ টাকা মাত্র*

**********************************************

File Name: Withholding Tax Return with Practicing File (English Version)

*Price Tk.600 only*

**********************************************

TDS & VDS Calculator

**********************************************

File Name: Supplier TDS & VDS Deduction

*Price Tk.500 only*

File Name: Service Bill TDS & VDS Deduction

*Price Tk. 400 only*

File Name: TDS & VDS Deduction from Advertisement, Office Rent & Others

*Price Tk. 300 only*

File Name: Salary TDS Calculator

*Price Tk. 600 only*

**********************************************

Other File

**********************************************

File Name: Advance Tax Calculator for (Company & Individual)

*Price Tk.400 only*

**********************************************

File Name: Gift Tax Return

*Price Tk.300 only*

**********************************************

File Name: Private Company Gratuity Calculation File

*Price Tk.500 only*

**********************************************